Why Profitable Companies Run Out of Cash (And How to Fix It)

The Problem Every Growing Company Faces—But No One Talks About

I'll never forget the look on the CEO's face.

We were sitting in his conference room, reviewing the 13-week cash flow forecast I’d built. He’d called me because "things felt tight," despite his company showing nearly $4M in annual profit."

He stared at the spreadsheet for a long moment. Then looked up at me, color draining from his face.

"Wait… we're profitable. How are we running out of money in six weeks?"

This was a representative example from a ~$28M SaaS company:

- 🚀 Fast growth

- 💼 Great product

- 🙂 Happy customers

- ⏳ Only ~6 weeks of cash runway

If this sounds familiar, you’re not alone. The "profitable but broke" problem is the single most common issue I see in companies between $5M–$50M in revenue.

Here’s the uncomfortable truth: profit and cash are not the same thing. And the gap between them destroys otherwise successful companies.

In this guide, I’ll show you:

- Why this happens (and why it gets worse as you grow)

- Where your cash is actually hiding

- The one financial tool that changes everything

- How to implement it in 30 days

Why Your P&L Is Lying to You

Here’s a scenario I see constantly:

Your accountant sends last month's P&L:

- Revenue: $2M

- Expenses: $1.6M

- Net Profit: $400K

You think: "Great month!"

Then you check your bank account:

- Beginning balance: $200K

- Ending balance: $85K

- Net change: - $115K

You think: "Wait… we just made $400K in profit. Where did it go?"

This isn’t a mistake. It’s

how accounting works — and why managing growth by looking only at your P&L is dangerous.

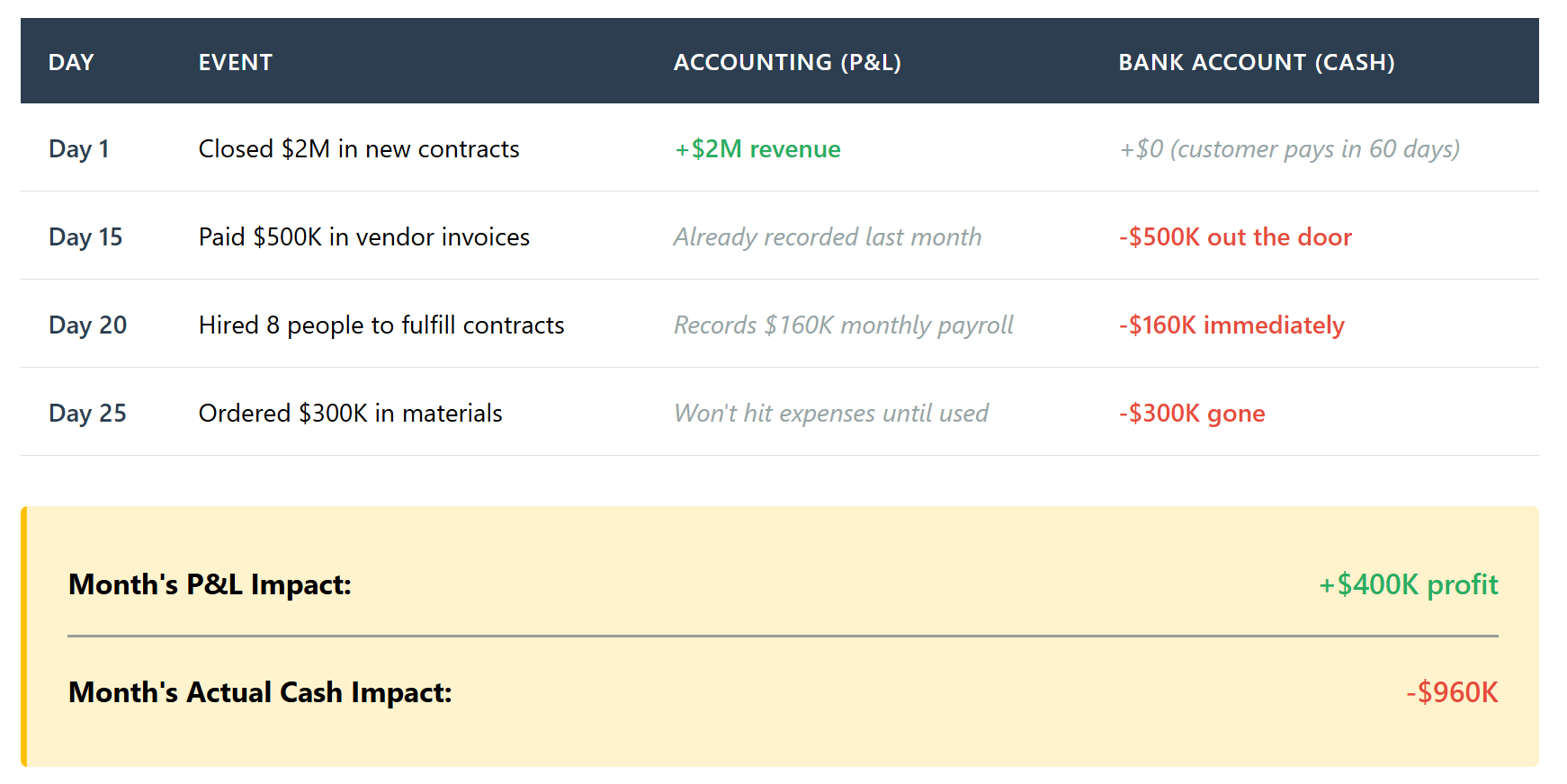

What Actually Happened That Month

Big difference between a P&L profit of $400K and a net cash outflow of $960K.

Your P&L is a report card. Your bank account is reality.

Most CEOs watch the report card and ignore reality… until they’re sweating payroll.

Why Growth Makes This Worse

The faster you grow, the more cash you need up front.

I see this pattern everywhere in companies between $5M–$50M:

- Customers pay in 60 days

- Vendors get paid in 30 days

- Payroll hits every 2 weeks

- Growth requires hiring, inventory, and upfront investment

Every new customer is a short-term cash drain before it becomes long-term profit.

Example:

Winning a $200K project:

- Day 1: Hire 3 people ($45K/month payroll starts)

- Day 1: Order materials ($30K paid immediately)

- Day 30: Send first invoice ($50K, customer pays Day 90)

- Day 60: Send second invoice ($50K, customer pays Day 120)

For the first 90 days, the company is

$120K+ in the hole — despite “winning” a profitable contract. Scale this across 10–50 customers, and you can see why profitable companies run out of cash.

Where Your Cash Is Actually Hiding

In my experience, cash gets trapped in three main areas:

- Slow-Paying Customers 💸

- Customers taking 70 days to pay on net-60 terms? You’re effectively giving them a 2+ month interest-free loan.

- Example: A $20M company with 70-day collections instead of 45 days has $1.4M trapped in AR.

- Poor Payment Timing ⏱️

- Vendors paid faster than customers pay you? That’s a cash gap.

- Example: Extending vendor terms from 25 to 45 days can release $300K–$800K in working capital for a $20M company.

- Excess Inventory or Inefficient Operations 📦

- Cash tied up in inventory, WIP, or prepaid expenses isn’t working for you.

- Example: Reducing inventory by 20% can free $150K–$400K.

The Solution: The 13-Week Rolling Cash Flow Forecast

This is the single most important financial tool for companies in the $5M–$50M range.

What It Is

A weekly projection of every dollar coming in and going out for the next 13 weeks, updated weekly.

- Not your P&L

- Not your budget

- Your actual cash movement

Why 13 Weeks?

- Covers a full quarter (strategic planning horizon)

- Weekly detail shows what monthly P&L misses

- Far enough out to solve problems, short enough to be accurate

What It Shows You

Instead of:

"I think we’re okay this month… let me check the bank balance."

You get:

"In Week 7, that big client payment gets delayed and our planned hiring in Week 8 will put us $180K short. We need to move the hire or use short-term financing."

One is reactive and stressful. The other is

strategic and calm.

Quick Wins: Free Up Cash in 30 Days

While building your forecast, try these three immediate improvements:

1️⃣ Tighten AR Collections

- Identify invoices >45 days outstanding

- Send reminders / follow-up calls

- Offer 2% early payment discounts

Impact: Reducing collections from 60 to 50 days = $300K+ freed for a $20M company

2️⃣ Negotiate Vendor Terms

- Extend top vendor terms from 30 to 45 days

Impact: Every 15 days of extension = significant cash available

3️⃣ Restructure New Contracts

- Move new deals to 30–50% upfront, milestone payments, net-30 terms

Impact: Immediate cash instead of 60–90 day wait

When You Might Need Help

Fractional CFO support can help if:

- You’re profitable but constantly stressed about cash

- You're unprofitable and need to get profitable

- You don’t have a 13-week forecast

- You’re preparing for a raise, acquisition, or exit

- Your controller handles compliance but not strategic cash

- You’ve taken PE investment and need institutional-grade reporting

What a fractional CFO delivers:

- 13-week cash flow forecast built & maintained

- Working capital optimization (DSO, DPO, inventory)

- Monthly financial review & strategic guidance

- Team training for self-sustaining processes

ROI: Most clients see

3–5x return in year one through released working capital, better decisions, and avoided financing costs.

Final Thoughts

Your

P&L tells you if you’re running a good business.

Your cash flow tells you if you’ll BE in business next quarter.

The “profitable but broke” problem isn’t a sign you’re failing — it’s a sign you’re growing and need better visibility.

Companies that scale successfully don’t just get more profitable. They see problems 12 weeks out instead of 12 hours out.

You can fix this. Start with the

13-week cash forecast this week.

Work With Me

I’m Nelis Parts, founder of Kyro CFO.

I help companies $3M–$50M build financial operations that scale without cash crises.

If you’re facing the “profitable but broke” problem, let’s talk.

Schedule a free 30-minute cash flow assessment → I’ll review your situation and show exactly where cash is trapped. No obligation, just clarity.